Printable PDF version

Subscribe to our newsletter

Cost Management

Heavy and Light Rail

TBD Bid Index

Windows Vista is Here!

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430

www.TBDconsultants.com

Cost

Management

Gordon

Beveridge

What is the difference between estimating and cost management? How do the two work together, and where does Value Engineering fit in? Gordon discusses these and other issues in this article.

Heavy and Light Rail Systems - On Track

Geoff

Canham

Light Rail and Heavy Rail systems are redefining our cities. What makes Light Rail light and Heavy Rail heavy? What differentiates one from the other? This article looks into these issues.

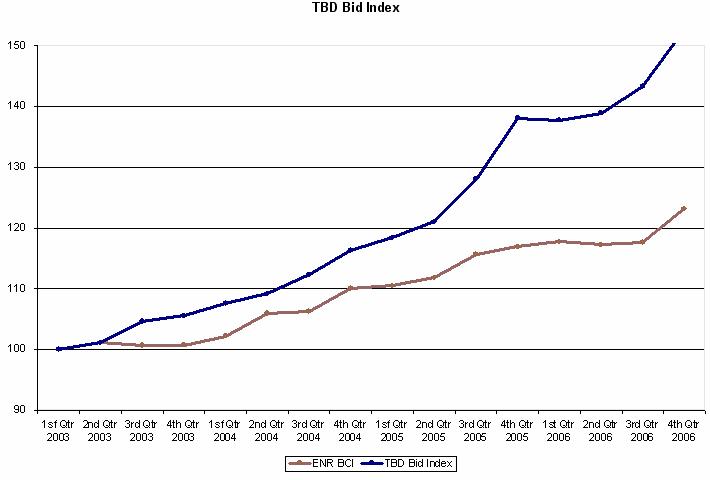

Our TBD Bid Index is now showing bid prices as being just over 50% higher than they were four years ago, with no immediate end to this increasingly upward trend in sight. We all know that these things go in cycles, and a downturn can be expected sometime, but currently the index is still showing a steepening rise. The TBD Index was launched in the second quarter of this year and is backdated to the start of 2003, being based on a school classroom building model.

The graph and chart below shows the trending in the last four years with the graph showing the TBD index plotted along with the ENR San Francisco Building Cost Index which represents the trend in selected labor and material prices. The difference between the two lines illustrates the gap between the bidding market and the narrow fines of an index based on raw cost of materials and labor.

| 2003 | 2004 | 2005 | 2006 |

|---|---|---|---|

| 1Q: 100.00 | 1Q: 107.62 | 1Q: 118.39 | 1Q: 137.80 |

| 2Q: 100.10 | 2Q: 109.17 | 2Q: 121.04 | 2Q: 138.93 |

| 3Q: 104.60 | 3Q: 112.33 | 3Q: 128.06 | 3Q: 143.36 |

| 4Q: 105.58 | 4Q: 116.33 | 4Q: 138.09 | 4Q: 152.65 |

One troubling spike in the graph is the jump in the ENR San Francisco BCI, because that is indicating a considerable rise in underlying labor and material costs, outside of market conditions. This is presumably reflecting the latest wage agreements, which have been considerably higher than those in preceding years, as well as the ongoing changes in material prices.

How long will this trend continue before we get a calming in the market? Some of the recent bidding has been described as 'predatory' or 'opportunistic', and while there is certainly some truth in that, the market conditions that are driving bid prices up so high are basically related to the old economic factors of supply and demand. The fact is that contractors and subcontractors generally have as much work as they can readily handle at present, and do not need to get every job that comes along. They are content to put in high prices, partly because they don't care if they don't get the job, but also because it is going to cost them to attract the staff to man the project if they do get it. They also need to cover themselves against potential material price rises. The contractors need to implement their own risk management against the kind of wild fluctuations that have been occurring in material prices, and which have forced some subcontractors into bankruptcy when they haven't been able to recoup the increases in their raw materials.

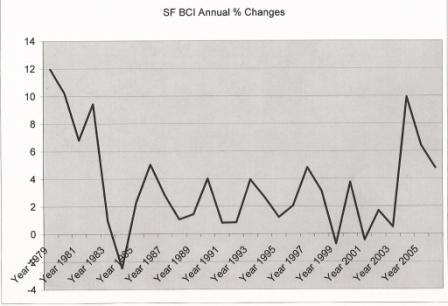

The chart above shows the way annual percentage changes in the ENR San Francisco BCI have occurred since 1979, and the bid prices would normally be expected to follow a similar, but exaggerated version of this graph. So, just as we have seen rapid increases in recent years, we can also expect some possible rapid reverses in the future, but how far into the future is still impossible to predict. A slowing down in the housing market is certainly occurring, which will free up some materials and labor, but the number of bonds that got passed in the November elections (providing for around $40 billion in construction work over the next ten years or so) is an indication that the volume of general construction is likely to remain high, plus the approaching SB 1953 deadlines in the healthcare industry will keep that market hot.

It is always dangerous to predict the future, however based on an informal survey of major contractors in the Bay Area we would recommend the following escalation rates going forward into 2007: For the twelve months ending in December 2007 we would recommend 8% and for the following two years 6% per annum. These predictions assume there will be a downward trend in escalation as measured in the last four years. The theory is that the current rates of inflation are not sustainable in the long term and in any event these rates should be revisited at least once a quarter.

Geoff’s

IT Gems

Windows

Vista is Here!

Microsoft XP has proved to be a very popular operating system, but now Windows Vista has finally arrived. Will the transition be easy or painful? What's new, and what's the same? Geoff has been trying out the beta version of Vista, and you can read his review of the new operating system by clicking the link below.

Design consultant: Katie Levine of Vallance, Inc.